How to Take the Stress out of Buying Holiday Gifts for Your Family

Arguably, one of the best parts about Christmas is giving holiday gifts to the people you love. Of course, before you can give gifts to people, you need to buy them first, which can be stressful for both you and your wallet. You’ll need to figure out what everyone wants (including people who “don’t want anything”), how much it’s all going to cost and how on earth you’ll be able to afford it all without going into debt.

Buying gifts doesn’t have to be stressful, though. If you follow a few guidelines, you can take the stress out of gift buying.

Set a Spending Limit

The best way to reduce stress related to gift buying is to give yourself a limit on how much you’ll spend. If you recoiled in horror when you read that, you’re not alone. Setting a monetary limit on how much you’re going to give people for Christmas seems wrong somehow like you’ve put yourself on a path to becoming Ebenezer Scrooge.

This is understandable. You don’t want to be stingy when giving gifts to your loved ones. However, you also shouldn’t have to put yourself in dire financial straits to make other people happy.

How much you decide to spend will depend on how much your family makes. One good rule of thumb is to spend no more than 5% of your annual income on holiday gifts. That might seem like a lot but take into account that’s the amount you’ll be spending for everyone on your gift list.

Ultimately, though, you should set a limit that makes you comfortable. Remember, it’s ultimately the thought that counts.

Start Early

For most people, the holiday gift-buying process starts on or around Black Friday and continues throughout the month of December. This makes sense. In addition to the phenomenal deals you can get on Black Friday and Cyber Monday, most people don’t really think seriously about what they’d like to get from Santa Claus until October at the earliest.

However, there’s nothing that says you can’t start your holiday shopping earlier. While you’re looking for gifts to get your family and friends, take some time to plan ahead and think about what they might like for next year. This doesn’t mean you should have your family make up next year’s wish list this year, but think about the hobbies and interests your family members have, and throughout the year keep an eye out for things they might want.

When you shop early, you not only have to deal with fewer crowds—you can also get discounts and sales on items they might like that rival Black Friday. If you have a child that likes skiing, for instance, a lot of companies have some good deals on skiing equipment when the snow starts to melt. Just make sure you have a good place to hide it!

Starting your holiday shopping early also means you won’t have to rely on your credit card as much. If you start saving for the holiday season in January, for instance, you can figure out how much you’d like to save up for December and adjust your budget so you can regularly put money aside for gifts.

Buy Experiences

Physical gifts are nice, but some of the most meaningful gifts aren’t things at all—they’re experiences, especially experiences you can share as a family. For instance, you can:

- Go see a play

- Visit an amusement park

- Take in a pro sports game

- Get private dance lessons

- Go kayaking in the Northwoods

- Learn to cook a gourmet meal together

- Take a family skiing trip

No matter what you choose, though, make sure to reserve some money for some physical gifts for your family so they can focus on them while they’re waiting for the experience.

Get Paid for Your Purchases

If you’re going to be spending a lot of money this holiday season, why not get some of it back? While many companies still offer rebates, these days you can also use apps like Botta and Upside to get some money back when you shop at certain stores.

You can also get money back for your purchases if you use a rewards credit card. The First Alliance Credit Union rewards credit card, for instance, gives you points on each item you buy. You can then use these points to get gift cards or cash back, and you can even take advantage of offers to get more points when you shop at certain locations.

No matter which rewards credit card you get, make sure to take full advantage of the rewards program. Be aware of the conditions you need to fulfill in order to earn the rewards, how the rewards program works, and constantly review your rewards through your online account to make sure the rewards won’t expire without your knowledge.

Make Gifts Yourself

If you don’t have a lot of money this holiday season, you can save a lot of money on gifts by making them yourself. If you like doing DIY projects, you could:

- Create personalized t-shirts with iron-on decals

- Knit some mittens, hats, or even a sweater

- Make salt scrubs

- Sew together rice-filled heating pads scented with essential oil

- Cook some holiday goodies

If you’re not particularly crafty, or just don’t have the time you need, you can always put together a personalized gift basket. Get a cheap container from the dollar store and fill it with little things you know the person will like.

Buy Second-Hand

For many people, this might seem like the ultimate holiday faux pas, but the truth is there’s nothing wrong with getting someone a gently used second-hand item. eBay is a good starting point for most people looking to score some holiday deals, but you could also visit Facebook Marketplace to look for some good local offers. You could also go to the Amazon Warehouse and see what’s available, and even visit ThreadUp if you have someone on your gift list who really likes nice clothes. A few items that make good gifts and are just as good second-hand are:

- Books

- Video Games

- Collectables

- Vintage Items

- Plants

- Bikes/Scooters

Plan for the Holidays With First Alliance Credit Union

It’s common knowledge that buying gifts can be stressful. However, it doesn’t have to be. You can save money by planning ahead, taking advantage of sales and discounts, and even get some money back for your purchases when you cash in rebates or get a rewards credit card.

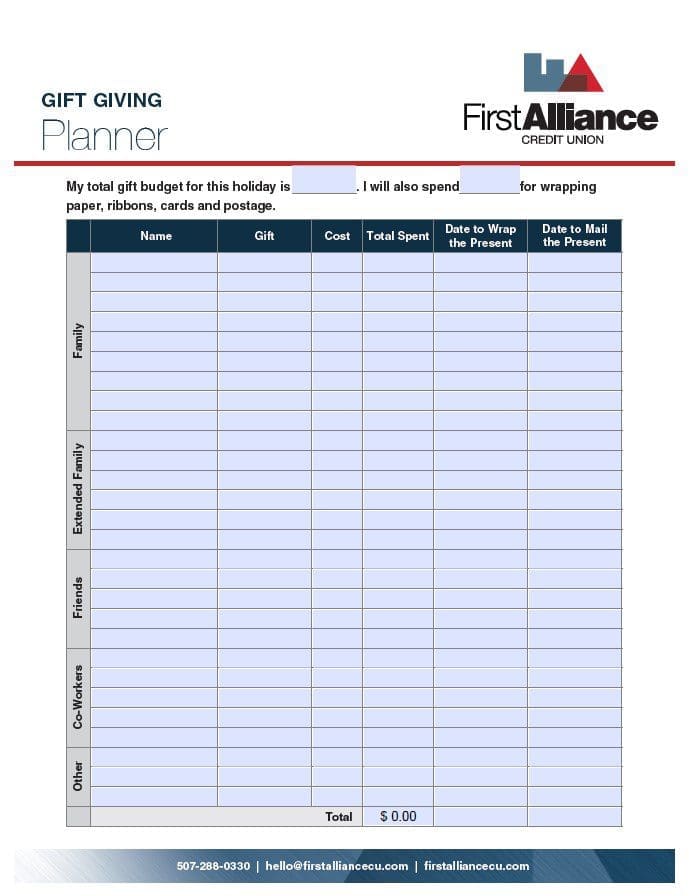

If you need help buying gifts for the holidays, become a First Alliance Credit Union member today. You can take the stress out of your gift-giving this year when you download our free Gift Giving Planner. You can also put money into a club savings account that will deposit the funds into your checking account in time for the holidays and even open a WINcentive savings account where you can win money simply by making regular deposits in your account!