Youth Month is a prime opportunity to celebrate our future Go-Getters by laying a strong financial foundation early on. Financial literacy goes beyond dollars and cents—it empowers young minds to make informed decisions, build confidence, and steer their own financial destinies. In this blog, we explore how to teach kids about money at various stages, introduce them to budgeting, and even spark entrepreneurial spirit in teenagers—all while keeping the experience fun and engaging.

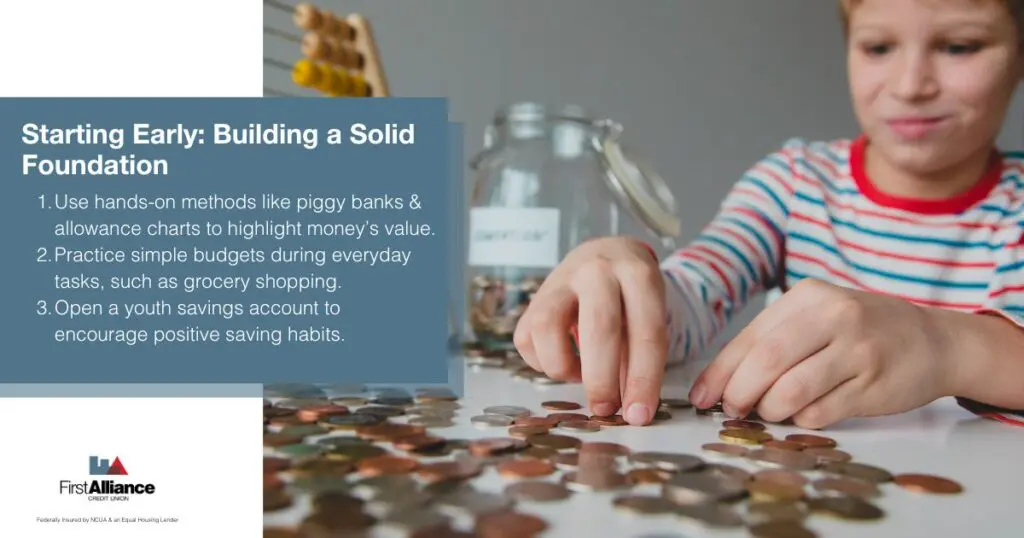

Starting Early: Building a Solid Foundation

The journey to financial literacy begins with the simplest ideas. For young children, learning about money should be hands-on and playful. Here are a few ways to get started:

The journey to financial literacy begins with the simplest ideas. For young children, learning about money should be hands-on and playful. Here are a few ways to get started:

- Introduce the Basics:

Use everyday activities such as setting up a piggy bank or creating a colorful chart to track allowances. These simple methods help children understand that money holds value and that even small savings can lead to rewards.

- Learning Through Everyday Moments:

Turn routine tasks into mini-lessons. For example, during a grocery shopping trip, give your child a small budget to “spend” and let them decide what to purchase. This practical application reinforces the importance of planning and prioritizing needs.

- Early Savings Tools:

Opening a Youth Account, like the Youth Share Savings Account at First Alliance, can be a great way to introduce children to banking. With a $5 minimum deposit, this account helps build good savings habits from the start.

Growing With Age: Tailoring Financial Lessons

As children mature, their financial education should evolve along with them.

For Young Children (Ages 0–12)

Focus on the fundamentals:

- Understanding Money:

Engage in simple activities like sorting coins or matching dollar bills to everyday items.

- Saving and Sharing:

Encourage kids to set aside a portion of any money received and allocate a bit for sharing. - Visual Tools:

Use jars or charts labeled “Save,” “Spend,” and “Share” to make money management tangible.

For Pre-Teens (Ages 10–12)

Pre-teens can start exploring more advanced topics:

- Budgeting Basics:

Introduce a simple budget by planning for small expenses, like school supplies or treats.

- Digital Learning:

Encourage the use of engaging resources—books, YouTube tutorials, and free online courses—that break down concepts like compound interest into practical lessons.

- Interactive Tools:

Digital apps, such as Greenlight, help bridge the gap between a physical piggy bank and modern money management by allowing kids to track spending, set goals, and even manage chores for extra funds.

Leveraging Digital Tools: Spotlight on Greenlight

In today’s digital world, technology offers exciting, hands-on ways to learn about money. One standout resource is the Greenlight app—a trusted debit card and mobile platform designed for kids and teens. Now available as a perk for First Alliance Credit Union members, Greenlight brings an interactive twist to financial learning:

- Tailored Experiences for the Family:

With Greenlight, both parents and up to five children can use the same app while enjoying personalized experiences. Kids receive their own debit card (which parents can control), giving them a sense of independence within a safe environment. - Flexible Parental Controls:

Parents can set spending limits at the store level, receive instant alerts when the card is used, and even automate allowances. This ensures that children learn to manage their money responsibly while parents maintain oversight. - Interactive and Educational Features: The app includes fun games that teach money skills—from smart spending to setting savings, earning, and giving goals. It even features chore management tools, turning everyday tasks into opportunities to earn extra funds. Such features make financial lessons engaging and relatable.

Help your kids master their money skills with help from our partners at Greenlight, the debit card app for families!

Teen Entrepreneurs: Turning Passion into Profit

For many teenagers, starting a business can be a practical way to apply financial skills. Simple ventures like cutting grass, babysitting, washing or walking dogs offer excellent opportunities for hands-on learning. These experiences teach essential lessons about planning, budgeting, and the value of hard work.

Making Financial Literacy Fun and Accessible

Financial education should be engaging, not a chore. Here are a few ideas to make learning about money enjoyable:

- Blend Digital and Real-World Learning:

Combine interactive apps like Greenlight with hands-on activities, such as family budgeting challenges or creative projects.

- Family Involvement:

Turn saving and budgeting into a fun family game, setting collective goals and celebrating progress together.

- Encourage Creativity:

Inspire kids and teens to use their creative talents in money-making projects—these practical experiences teach real-world financial management skills.

Conclusion: A Bright Financial Future Starts Now

Investing in financial education from a young age is a gift that keeps on giving. From early lessons on saving and sharing to advanced topics like budgeting, credit, and entrepreneurship, every step builds a foundation for lifelong success. By equipping our youth with these essential skills, we empower them to become confident, savvy, and independent.

At First Alliance Credit Union, we’re committed to supporting families on this financial journey. Whether you’re starting with a Youth Account or exploring digital tools like Greenlight, every small step helps build a secure future. Celebrate Youth Month by opening an account and setting your child on the path to financial success!

Have more questions about how to teach kids financial literacy? Ask us!

Program Disclaimer: *First Alliance Credit Union members are eligible for the Greenlight SELECT plan at no cost when they connect their First Alliance Credit Union account as the Greenlight funding source for the entirety of the promotion. Subject to minimum balance requirements and identity verification. Upgrades will result in additional fees. Upon termination of promotion, customers will be responsible for associated monthly fees. See terms for details. Offer ends 10/15/2026. Offer subject to change and partner participation.

Mastercard Issuing Statement: The Greenlight® prepaid card is issued by Community Federal Savings Bank, member FDIC, pursuant to license by Mastercard International.