This post is sponsored by First Alliance Credit Union

Should you Pay for College?

According to some conventional wisdom, one of the essential duties of parents is to save up enough money to pay their child’s tuition when they go to college. If you don’t, you’re somehow setting your child up for failure as an adult.

The reality, though, is that there are several good reasons why you might not want to pay for your child’s tuition. One of the biggest reasons is that the cost of college has skyrocketed, increasing 169% from 1980 to 2020. Many parents simply don’t have enough money of their own to fund their child’s college tuition without making some heavy sacrifices—especially if you’re still paying off your own college debts!

Determining whether you should pay for college for your child or not is a big decision for any parent. Here’s what you need to know to help you choose.

Why you Should Pay Your Child’s Tuition

The benefits of saving for your child’s tuition are obvious. Your child gets a college education, which will increase the chances they get a job that pays well when they graduate. Even better, they’ll do it without being thousands of dollars in debt, which means they’ll be able to put that money towards something that benefits them.

Paying for your child’s college also lets them get an education without the stress of having to pay for it. This gives them time to enjoy themselves, make new friends, and join clubs that will expand their horizons. It will also give them some breathing room so they can seriously consider what they’d like to do once they graduate.

It’s also worth pointing out that federal and state governments offer special savings accounts for parents who want to put aside money for their children. A Coverdell Educational Savings Account, for instance, will let you invest the money you deposit in the account without you having to pay interest on the dividends. Even better, your child will be able to spend the money without having to pay taxes on it, so long as they use the money for educational expenses.

Why you Shouldn’t Pay Your Child’s Tuition

While many parents believe strongly in saving for their child’s college tuition, a lot of other parents have no plans to pay for their child to attend college. The biggest reason they give is that if a child has to pay their own way through college, they’re more likely to fully appreciate the experience.

Another reason parents give for not wanting to pay for their child’s tuition is that it gives their child the option to do something else. Several jobs don’t require a four-year degree to do well, and a lot of people love jobs that involve working with their hands, like woodworking or carpentry. These jobs might not have the prestige of some white-collar jobs, but they are important, and the people who do them earn a decent salary.

It’s not a Yes-or-No Choice

Of course, for many parents, the choice to pay for their child’s college education isn’t just yes or no. Many parents might not be able to pay all their child’s college fees, but they can pay for part of them. For instance, you could:

- Pay for the tuition, but not the textbooks

- Cover room and board

- Give your child a monthly or annual allowance

You can also help your child pay for college by cosigning loans for them. If you do this, though, you’ll want to review the conditions of the loan with your child. Talk about how much they’ll need to borrow from a private lender, what the expected payment is, and figure out what steps you’ll need to take if your child has difficulty finding work after graduating from college.

You can also help your child by discussing ways to save money while still getting a college education. For instance, your child might want to put off going to college for a year while they work full-time. They can use the money they’ve earned to put toward their tuition, either in a 529 plan or in a high-interest money market savings account. You should also encourage your child to apply for scholarships and grants, which can save them thousands of dollars they won’t have to pay back to a lender.

You might also want to talk with your child about the benefits of starting their college education at a community college. These offer almost all the benefits of taking classes at a four-year university at a fraction of the cost. In fact, many students go to a community college for two years, then transfer to a four-year university to get their bachelor’s degree.

How to Decide

How to Decide

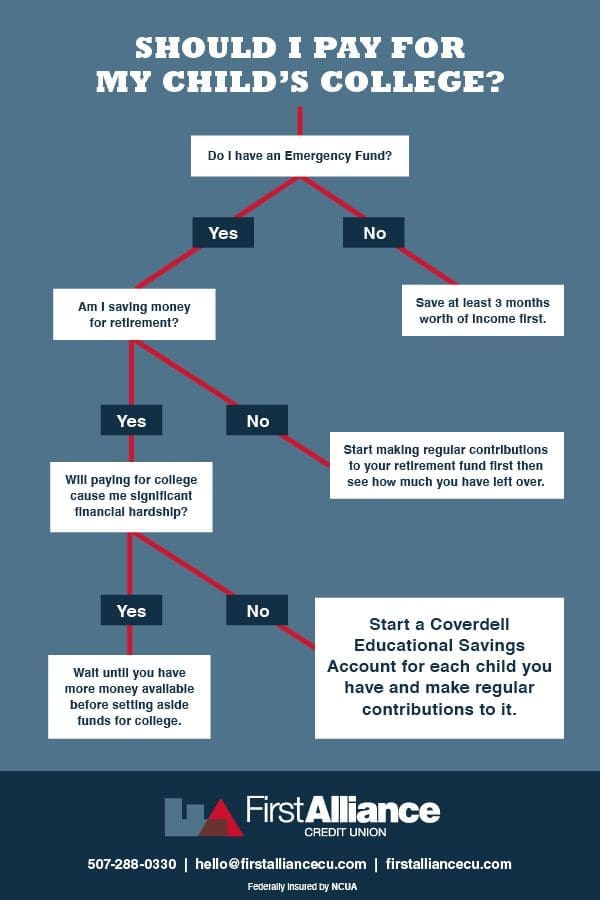

Ultimately, there’s no right or wrong answer to whether you should pay your child’s tuition. Both choices have advantages and disadvantages. However, there are some questions you can ask yourself to help guide you to the best answer for your child.

How are your finances?

You shouldn’t sacrifice your own financial well-being in order to put your kids through college. Before you start funding your child’s education, make sure your family’s financial needs are taken care of. That includes having an emergency fund with at least three months of income in it and a retirement fund to which you’re regularly contributing.

You’ll also want to think about how much debt you’re carrying. If you’ve got a lot of debt, especially debt with a high-interest rate, you should prioritize paying it off or consolidating your debts into one payment before saving for your child’s tuition.

How many children do you have?

If you have more than one child, you’ll need to think about how much money you’ll have to save for all their tuition costs. If not, you might find that you’ve exhausted your education fund savings on one child, with nothing left for the others.

You’ll want to divide up the amount you’ve saved between all your children and figure out how much you can afford to give each one. In order to ensure that the process is fair, you can also open up Coverdell educational savings accounts for each child and divide the money equally between all accounts. You should also let all your children know how much you’re contributing and help them figure out how to pay for the rest.

What are your child’s career plans?

A college education can give your children a huge advantage, but it’s not the best choice for every career. If your child wants a hands-on career like auto repair and carpentry, for instance, a trade school or an apprenticeship will help them more than a four-year degree.

Save for Your Child’s College Education With First Alliance Credit Union

Figuring out whether to pay for your child’s college education is a big decision. You’ll need to consider several factors, including the state of your personal finances, how many children you have, and even what kind of job your child wants to have. No matter what your decision is, though, you’ll want to discuss it with your child and help them understand what they’ll have to do to pay for college.

If you’re getting ready to save for your child’s college education, become a member of First Alliance Credit Union today and ask about our Coverdell Education Savings Account.